In my first post on stock investing and using learned lessons of missed opportunities and so many mistakes, I thought it would be important to perform a retrospect. However, it’s worth noting I didn’t follow my own advice and got caught up in the same gambling stage that most investors do. You get the win and you think you can keep winning instead of listening to the statistics.

Before you start thinking, “oh, this is going to be a glorious failure,” I’d like to point out that (thankfully) you’re wrong.

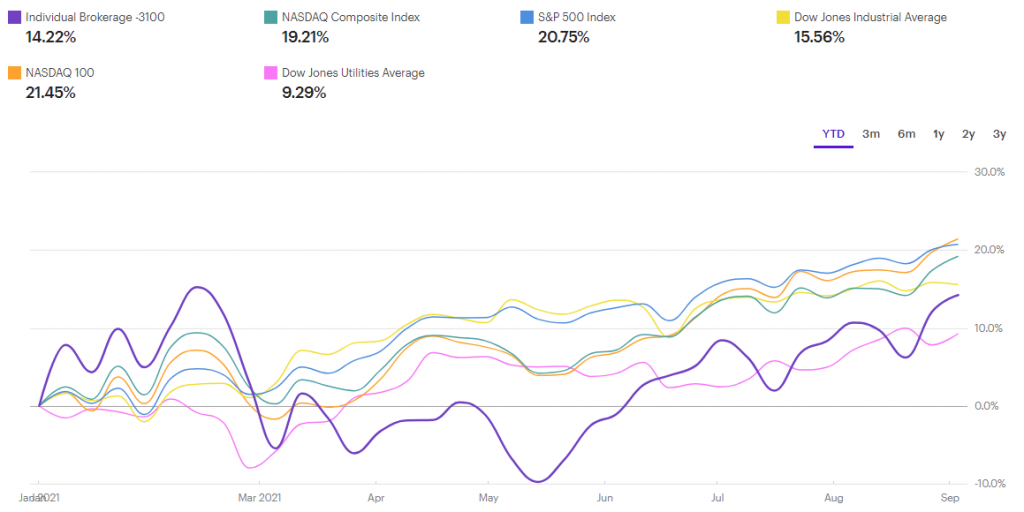

While I didn’t perform as well as investing in a standard stock like SPY for the S&P500, I outperformed Dow Jones Utilities Average. This is one perspective. Since my post last year, it’s a slightly different story:

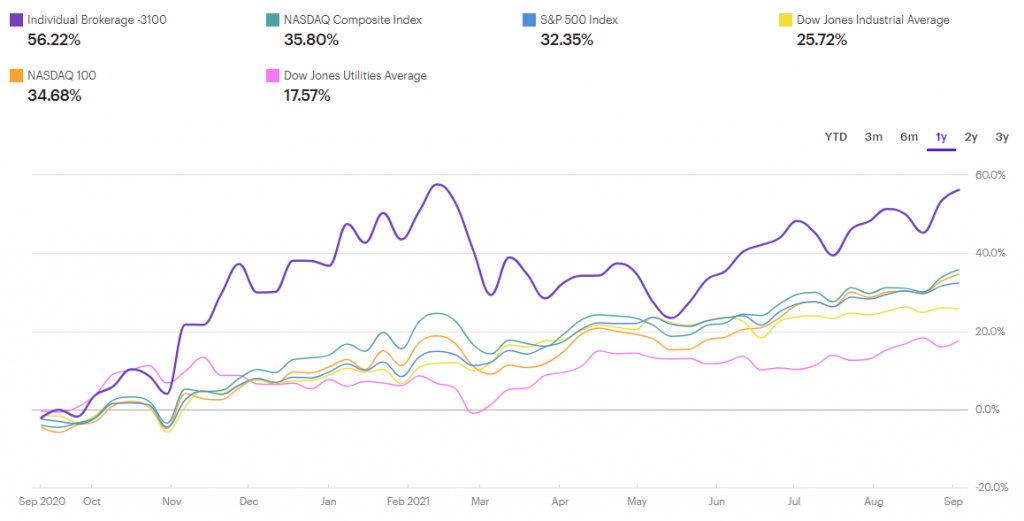

I nearly doubled the closest stock index. I don’t know what happened in March and May, but M-months clearly hate me and now I hold a personal grudge against them. Going back to the original point: Where did I deviate?

- Not all stocks I invested in have dividends

- Some stocks I invested in potential even though there was no info on company culture OR

- Some stocks I ignored company culture

- In some cases I invested in an ETF

- Some stocks I didn’t hold on to and sold at a loss

- I never looked at technical indicators for an entry point

I’ll talk about only a few of these since some are self-explanatory.

Some stocks I invested in potential even though there was no info on company culture or I ignored company culture. One such company is Amplitech (AMPG) that builds RF equipment for satellites, 5G networks, and other stuff. I have a -64% return on them. I’m holding on to their stock because:

- 2021 Q2 revenue grew by 55%, doubling their quarterly revenue last year at same time

- Secured amplifiers for Global Satellite Broadband Services

- Received contract for defense contract for space program

Another one is AppTech Corp (APCX) with a -72% return. Although, their GlassDoor reviews are well-received despite having only four reviews. They handle electronic payment processing and merchant services, which is nothing spectacular when you have companies like PayPal and Square. What catches my attention is that they have new partnerships with Innovations Realized LLC, NEC Payments, and have had steady revenue growth through the past several quarters. Their expenses are off the rails due to investments in research, which is hurting their stock price, but I suspect it will bounce back in a few years.

In some cases I invested in an ETF

Some ETF’s I invested in because I feel like there’s a shift towards a specific industry, but have no knowledge in it or not enough to feel comfortable investing in companies that are in that industry. For example, the ARKX Space Exploration and Innovation ETF is focused on the space industry. I also put some money towards 3D Printing with PRNT as I expect more goods to be printed rather than manufactured through the traditional sense. I think the biggest game changer in the fuel industry is hydrogen, so I also invested in HDRO. While many people are focused on EV cars, I think semi-trucks, ships, planes, and power will come from hydrogen. Japan and Germany have already invested billions in this research. Each of these ETFs are floating around zero gains right now, but so was QCLN for a couple of years (see below).

Some stocks I didn’t hold on to and sold at a loss

One stock I sold was Berkeley Lights, which I know nothing about and was honestly trying to ride a wave of investors that thought it was going to take off. While the financials look good and the culture look good, it doesn’t honestly attract me. I also sold DraftKings (DKNG) and Apple (APPL). I think DraftKings has more potential to grow, but I think it’s nearing its limits especially as other strong competitors come into the market. For Apple, I don’t have faith in the finances with the Antitrust lawsuits going on. I feel like those will have a huge impact on their revenue as other app stores open and/or apps accept payments directly through a service they prefer.

Best Performers:

- NIO (554.81%) – Invested in this when I saw them in China and thought, “that’s a neat car”. It’s also electric.

- MRNA (250.49%) – Well, obviously Covid vaccines, but they have some incredible research coming through outside of SARS-CoV-1 involving mRNA. I only knew about this company and its research since I worked at a pathology lab.

- QCLN (219.62%) – Clean energy is growing faster and faster. No surprise here.

- HUBS (124.51%) – There’s always a need for marketing and this is the best CRM out there

- AMD (107.33%) – Processors and graphic cards. It’s either them or nVidia, but your investment can’t go wrong. I prefer AMD products.

TL;DR

Buffalo buffalo Buffalo buffalo buffalo buffalo Buffalo buffalo.